How to Value a Business in the UK

The Complete 2026 Owner’s Guide

Introduction: Why Every Business Owner Needs to Understand Value

Most business owners have no clear idea what their company is actually worth. Some assume a multiple of profit, others guess based on what they “need to retire”, and many rely on stories from friends or accountants. The truth is that value isn’t fixed, it’s a moving target shaped by performance, market confidence, and buyer appetite.

Understanding what your business is worth today is not just about planning a sale. It’s about control, knowing where you stand, what drives value up or down, and what you can do about it long before an offer ever lands on your desk.

A professional valuation gives you perspective. It helps you decide whether to grow, sell, or restructure, and it protects you from underselling years of work. Whether you’re planning an exit, an employee ownership transition, or simply exploring your options, this guide will show how the UK market really determines value, not theory, not guesswork, but the methods buyers and advisers actually use.

Add your own content here. Click to edit.

BusinessValuation.co.uk provides confidential, independent valuation guidance for UK business owners.

1. What “Value” Really Means

In straightforward terms, a business valuation is an informed estimate of what a willing buyer might pay and a willing seller might accept both acting sensibly and without pressure. It isn’t a guarantee, and it isn’t what you think it’s worth; it’s what the market believes it’s worth based on risk and return.

A valuation represents the relationship between profit, growth, and risk. Buyers are effectively purchasing your future earnings. The higher and more reliable those earnings, the more they’re prepared to pay.

________________________________________

• Price is what someone actually pays on the day.

• Worth is what you believe it should be worth, usually emotional and often inflated.

• Value is the reasoned figure that bridges the two, what a qualified buyer could justify paying based on evidence.

Valuations also depend heavily on context. A business valued for sale may be assessed differently from one valued for tax, investment, or legal purposes. For this reason, you’ll often hear professionals refer to Enterprise Value (EV) and Equity Value:

• Enterprise Value represents the value of the entire business, debt included.

• Equity Value is what’s left for shareholders after debt is repaid and surplus cash is removed.

When selling, most deals are agreed on a “cash-free, debt-free” basis. That means a buyer values the enterprise (EV), then adjusts for cash and borrowings to determine the equity price paid at completion.

________________________________________

Indicative vs Formal Valuations

There are two broad levels of valuation:

1. Indicative valuation – a practical range used for planning, funding, or exploring options. It relies on available financials, market comparisons, and recent deal data.

2. Formal valuation – a detailed exercise required for HMRC, share transfers, or legal processes (e.g. Employee Ownership Trust transactions). It uses stricter assumptions and supporting documentation.

Both are valuable, but an indicative valuation is often the most useful starting point for owners. It highlights what drives value, identifies weaknesses, and shows what to fix before taking the business to market.

Price, Worth, and Value — Three Different Things

2. The Main Valuation Methods Used in the UK

There are dozens of theoretical valuation techniques, but in the UK SME sector, only a few truly matter. Most advisers, buyers, and lenders rely on a small set of practical, proven methods adapted depending on the nature of the business.

Let’s look at the main approaches used in real-world transactions.

________________________________________

The Earnings Multiple Method

By far the most common approach.

This method values a business based on its maintainable earnings, typically normalised EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) multiplied by an appropriate sector multiple.

Formula:

Business Value = Normalised EBITDA × Multiple

For example:

If your business generates a maintainable EBITDA of £400,000 and attracts a multiple of 5×, the enterprise value would be £2,000,000.

The art lies in determining both parts of that equation:

• Normalised EBITDA adjusts reported profit to reflect true maintainable performance. That might involve adding back a director’s excessive salary, one-off legal fees, or removing non-recurring income.

• The Multiple reflects perceived risk and attractiveness. Higher multiples are paid for strong recurring revenue, diversified customers, scalable models, and capable management teams.

Typical UK private-company multiples range from 3× to 8× EBITDA, depending on sector, scale, and risk.

Service-based firms with recurring income tend to attract the upper end; project-based or owner-dependent firms sit lower.

________________________________________

Asset-Based Valuation

This approach values the net assets of the business, tangible and intangible, adjusted to market value. It’s suitable for asset-heavy sectors (property, manufacturing, transport) or where profitability is inconsistent.

Formula:

Business Value = Total Assets (at fair value) – Liabilities

While simple, this method ignores goodwill, brand strength, and earning potential. It’s often used as a floor valuation, what the business would be worth if sold for parts rather than as a going concern.

________________________________________

Discounted Cash Flow (DCF)

A more sophisticated, forward-looking method, DCF calculates today’s value of expected future cash flows, discounted back to present value.

Used mainly for larger businesses or investment cases, it requires detailed forecasts and an appropriate discount rate (reflecting risk and cost of capital).

Although technically sound, DCF can be too theoretical for SMEs. A small change in assumptions can dramatically alter the result, so most advisers use it to cross-check rather than lead.

________________________________________

Rule-of-Thumb / Revenue Multiples

Some industries, especially agencies, e-commerce, and recurring-revenue service firms, quote rough “revenue multiples” (for instance, 1× annual turnover).

These can be misleading because they ignore profitability and capital structure, but they do provide a quick market pulse.

If you see a competitor sell for “1× sales”, that’s shorthand for a business with predictable income and healthy margins.

It’s not a universal rule and shouldn’t replace proper analysis.

________________________________________

Valuation for Employee Ownership Trusts (EOTs)

Where a company transitions to an Employee Ownership Trust, valuation must be fair, evidence-based, and independently verified. HMRC expects valuations to follow recognised methods, usually an earnings-based or hybrid approach ensuring employees don’t overpay and sellers receive a fair but reasonable price.

This adds another layer of scrutiny: the valuation must satisfy tax, legal, and trustee review standards.

Because of that, EOT valuations are often more conservative but highly defensible.

________________________________________

Choosing the Valuation Right Approach

Most professional valuers use a combination. For example, an earnings-based valuation supported by an asset floor and informed by sector revenue multiples.

This triangulation produces a range rather than a single figure, typically a valuation band showing realistic lower and upper limits.

3. What Business Buyers Are Really Paying For

Business buyers aren’t paying for what your business has been, they’re paying for what it can keep doing without you.

That’s the key difference between a company that sells for three times earnings and one that sells for six.

When valuers and buyers assess a business, they focus on four fundamental elements: profit, growth, risk, and transferability.

Each factor either adds or subtracts from the headline valuation multiple. Let’s look at how each one works in practice.

________________________________________

Profit – The Engine of Value

Profit is the starting point of every valuation. But buyers don’t care about reported profit; they care about sustainable, maintainable profit.

• If your accounts show strong, consistent earnings over three years, confidence rises and the multiple improves.

• If profits swing wildly, or are propped up by one-off contracts, buyers assume volatility — and the multiple falls.

• A business showing £500k in consistent, recurring EBITDA over several years is far more valuable than one showing £700k with peaks, troughs, and dependencies.

The message: clean, repeatable profit sells; spikes and stories don’t.

________________________________________

Growth – The Multiplier Effect

Growth is what turns a decent deal into an exceptional one.

Buyers will pay a premium if they can see credible, achievable growth that doesn’t rely solely on luck or personality.

Examples of growth factors that increase value:

• A proven ability to scale profitably (e.g., adding customers without adding excessive cost).

• New or protected markets (geographic or sector diversification).

• Intellectual property, contracts, or systems that allow expansion without founder involvement.

• Recent investment in technology or automation that unlocks future margin gains.

Conversely, a “mature” or flat business, even if profitable, may command a lower multiple because the upside is limited. Buyers pay for future potential, but only if they can see how it’s achieved.

________________________________________

Risk – The Silent Valuation Killer

Every risk reduces value because it increases the buyer’s uncertainty about future returns.

Professional buyers run through a mental checklist of vulnerabilities, such as:

• Customer concentration: one client generating over 20% of turnover.

• Owner dependency: where the business revolves around you personally.

• Key staff reliance: no second-in-command or succession plan.

• Supplier or product reliance: single-source risk or outdated offering.

• Weak financial systems: missing management accounts, unclear forecasting, poor debtor control.

Each red flag chips away at confidence. Even if profits look strong, too much dependency or risk means the buyer has to work harder post-acquisition and they’ll adjust the price accordingly.

Risk doesn’t just lower multiples; it can kill a deal outright.

Reducing risk through better management, processes, and documentation is often the fastest way to lift value without increasing turnover.

________________________________________

Transferability – Can It Run Without You

Transferability is what ultimately decides whether a business is sellable at all.

Buyers need to know that the business will perform the same after completion as it did before. If it can’t, they’ll discount the price heavily or walk away.

Key indicators of transferability include:

• A capable management team with delegated responsibility.

• Documented systems and procedures (operations, finance, HR, sales).

• Strong customer relationships managed by the team, not the owner.

• Clean, transparent data rooms and well-organised records.

If the business relies on your relationships, charisma, or daily involvement, it’s not a saleable asset, it’s a well-paid job.

True value comes from creating an organisation that runs under management, not under the founder’s thumb.

________________________________________

How These Factors Interact

You can think of these four factors as dials on a control panel:

The more dials you turn up, the higher the multiple you earn.

That’s why two firms with identical profits can have valuations millions apart, one has built an organisation; the other has built a dependency.

________________________________________

Example: Two Engineering Businesses

Company A:

-

Turnover £3.2m, EBITDA £480k, owner still managing day-to-day.

-

80% of revenue from three customers, no formal management team.

-

Valuation multiple: 3.5× EBITDA = £1.68m.

Company B:

-

Turnover £3.1m, EBITDA £460k, structured team, ISO-certified,

-

Recurring maintenance contracts, diversified client base.

-

Valuation multiple: 6× EBITDA = £2.76m.

Same size. Same profit. Almost £1.1m difference purely down to risk and transferability.

________________________________________

The Real Takeaway

Buyers aren’t paying for turnover or history, they’re paying for certainty of future earnings.

Your job as an owner is to make the business look as safe, scalable, and transferable as possible. The less it needs you, the more valuable it becomes.

If you’re unsure how your business would perform under these tests, start with a confidential valuation. We’ll benchmark your company against real UK market data and show where value is being lost or created.

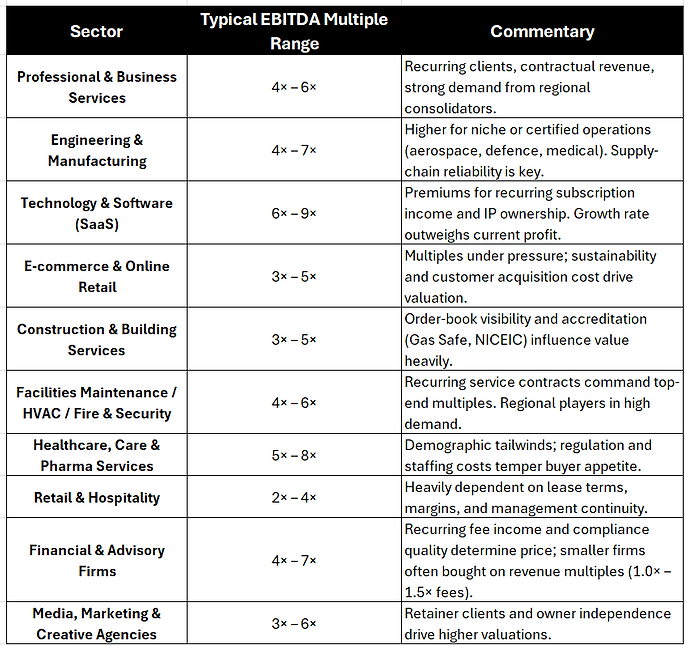

4. Market Multiples – 2025 / 2026 Benchmarks

When business owners talk about “what multiple they’d get ”, this is what they mean, the earnings multiple applied to their maintainable EBITDA. It’s the shorthand that turns financial performance into market value.

In practice, multiples move constantly. They rise with confidence and cheap capital; they tighten when the economy wobbles or interest rates climb. The UK’s SME market is stabilising after a period of volatility, deal flow is healthy, but buyers are more selective and due diligence is tougher than ever.

________________________________________

Current UK Private-Company Multiples (2025 / 2026 guide)

(Ranges derived from aggregated UK private-market transaction data, adviser experience, and deal analytics through early 2025.)

________________________________________

What’s Driving Business Valuation Multiples in 2026

1. Interest Rates & Capital Costs – Higher borrowing costs have trimmed leveraged-buyout appetite. Cash buyers and trade acquirers dominate, favouring businesses with stable earnings and low working-capital strain.

2. Private-Equity Caution – Funds remain active but are cherry-picking quality. Expect premium pricing for scaleable, process-driven firms; discounts for anything reliant on a founder.

3. Strategic Consolidation – Trade acquirers are pursuing bolt-ons to gain market share. These buyers often pay a strategic premium, sometimes 1–2 × EBITDA higher than financial buyers.

4. Employee-Ownership Growth – EOT transactions have normalised in the £2m–£20m EV range. Fair market valuations (4× – 6× EBITDA) are now well-established benchmarks, underpinning mid-market confidence.

5. Post-pandemic Resilience – Businesses demonstrating sustained recovery and digital integration are commanding stronger multiples than pre-2020 equivalents.

________________________________________

Illustrative Example

A maintenance services firm with £400k maintainable EBITDA, recurring client contracts, and ISO accreditation could expect:

• Base valuation: £400k × 5 = £2.0 m

• Adjustment for strong management & low risk: + 0.5–1.0 × = £2.2 – £2.4 m

• Adjustment for client concentration or owner dependency: – 0.5 × = £1.8 m

A single risk factor can alter value by several hundred thousand pounds. This is why “multiples” are a range, not a rule.

________________________________________

Why Published Multiples Can Mislead

• Outdated Data: Deal data lags 6–12 months behind market sentiment.

• Size Matters: Smaller firms (<£1 m EV) trade 10–30 % below headline ranges due to perceived risk.

• Structure Distortion: Earn-outs and deferred payments inflate published prices.

• Sector Averaging: Aggregated tables hide variance between recurring and project-based models.

A good valuation always adjusts for these distortions.

The role of a professional valuer is to apply judgment, understanding which side of the range your business truly sits on and why.

________________________________________

2026 Business Valuation Outlook

Barring major shocks, UK private-company multiples are expected to hold steady through 2025, with slight upward pressure in service and maintenance sectors and continued strength in software and niche engineering. The biggest gains will go to well-systemised, recurring-income businesses that can demonstrate management independence.

To understand which multiple your business would attract in the current market.

5. Adjusting for Normalised Profit

When valuing a private company, one of the biggest mistakes owners make is using their accounting profit straight from the year-end accounts.

Buyers and valuers don’t start there, they work from normalised profit, also called maintainable earnings.

This is a realistic measure of what the business can continue to earn under normal trading conditions, after removing anything personal, exceptional, or temporary.

Normalisation ensures that the valuation reflects the business, not your lifestyle, tax strategy, or one-off events.

________________________________________

Why It Matters

An unadjusted profit figure can distort value in either direction:

-

Overstated: inflated by one-off contracts, grants, or delayed costs.

-

Understated: reduced by owner remuneration, personal spending, or growth investment.

Two identical businesses could show completely different profits on paper simply because one owner takes a salary of £50,000 and the other takes £150,000 plus dividends.

A proper valuation corrects that imbalance so both are compared fairly.

________________________________________

Typical Normalisation Adjustments

________________________________________

Worked Example

A manufacturing business reports the following for its latest financial year:

Now, applying a sector multiple of 5× produces:

£355,000 × 5 = £1,775,000 Enterprise Value

If the owner had used the unadjusted £310 k, the same multiple would show £1.55 m, a £225,000 difference based purely on cleaning up the numbers.

________________________________________

Quality of Earnings Review

Buyers will perform their own “quality of earnings” test during due diligence.

If they find hidden personal costs or inconsistent accounting, they’ll re-cut the numbers and reduce the offer.

Doing the work upfront not only lifts value, it also builds credibility and shortens due-diligence negotiations.

________________________________________

Quick Checklist

Before commissioning a formal valuation or sale process:

-

✅ Review last three years’ accounts for consistency

-

✅ Prepare a clear reconciliation showing every adjustment

-

✅ Replace personal or discretionary costs with commercial equivalents

-

✅ Document assumptions — it builds buyer confidence

-

✅ Be prepared to evidence figures with invoices or notes

Ready to see how your own adjusted profit converts into market value. Submit your latest accounts for a confidential, no-obligation review.

6. Beyond the Numbers – The Human and Strategic Factors

Valuation is never just about profit and multiples.

A spreadsheet can tell you what a business should be worth, but it’s the human and strategic factors that decide what it actually sells for.

Two companies with identical earnings can achieve wildly different prices depending on how well they’ve built trust, credibility, and future potential in the eyes of a buyer.

Buyers don’t simply buy accounts, they buy confidence.

Confidence that the business is real, stable, transferable, and capable of growth.

________________________________________

Brand and Reputation

A strong, recognisable brand commands a premium because it shortens a buyer’s due-diligence process and reduces risk.

If the name is respected, visible, and associated with quality, the buyer starts from a position of belief and belief translates to higher multiples.

Ask yourself:

• Would customers stay if ownership changed?

• Does the business have positive online presence, reviews, or awards

• Is the brand protected through trademarks, domain names, or reputation in its market niche

Firms with strong brands often secure faster completions, smoother negotiations, and fewer post-sale disputes.

In contrast, businesses with dated branding or poor visibility may appear riskier, even if their financials are sound.

________________________________________

Customer Mix and Retention

Customer quality matters more than quantity.

A business with 100 loyal, recurring customers is worth more than one with 1,000 occasional buyers.

Retention rates, recurring revenue, and contract length are key indicators of stability.

Buyers want evidence that:

• Customers are under contract or repeat by habit.

• No single account dominates turnover.

• Revenue won’t collapse once the owner leaves.

Improving customer diversification and retention before sale can add 0.5–1.0× to your valuation multiple, sometimes more.

________________________________________

Management Depth and Succession

One of the fastest ways to destroy value is to make yourself indispensable.

If the business can’t function for a month without you, it isn’t a business, it’s a dependency.

Buyers pay premiums for management continuity, because it lowers operational risk and protects post-completion performance.

Signs of good management depth include:

• A defined leadership team with delegated authority.

• Clear reporting structures and role accountability.

• Decision-making processes that don’t bottleneck at the owner.

If you can take a two-week holiday without the business stalling, you’ve already improved your sale price.

________________________________________

Systems, Processes, and Documentation

Buyers value order and reliability.

Documented systems for finance, operations, sales, and HR, reduce handover friction and signal professionalism.

A business with strong internal processes is easier to integrate, scale, and finance, which makes it more attractive.

Before sale, ensure you have:

• Up-to-date management accounts and KPI dashboards.

• Written procedures for key functions.

• Secure data storage and accessible records.

• Evidence of compliance, certifications, or accreditations.

When a buyer can see your house is in order, they’ll spend less time negotiating and more time offering.

________________________________________

Timing and Market Conditions

Even a well-run business can underperform on price if it’s sold at the wrong time.

Market cycles, interest rates, tax changes, and buyer sentiment all influence achievable value.

As a rule:

• Sell from strength, not exhaustion.

• Monitor your sector’s deal activity — rising multiples usually precede peak demand.

• Consider pre-sale improvements at least 12–18 months before marketing.

Timing the market perfectly is impossible, but being prepared when conditions are right is entirely within your control.

________________________________________

Strategic Fit – The Hidden Premium

Sometimes a buyer will pay well above market value simply because your business completes their puzzle.

That’s the strategic premium, when the value to them is greater than to anyone else.

Examples:

• A competitor buying access to your contracts or geography.

• A supplier acquiring you to secure distribution.

• A private-equity group seeking a platform company with bolt-on potential.

These premiums are real and can add 20–50% to the final price, but they only emerge when the business is positioned professionally and confidentially in the right buyer network.

________________________________________

The Combined Effect

When financial performance is supported by strong human and strategic factors, buyers stop negotiating on numbers and start competing on opportunity.

That’s when sellers achieve the highest multiple and the cleanest deal structure, not because they haggled harder, but because they presented better.

________________________________________

Understanding your business’s financials is only half the story. To discover how your management, systems, and brand affect real-world value.

7. Tax, Structure, and Legal Considerations

A business valuation tells you what your company might be worth, but it doesn’t tell you what you’ll keep.

The structure of the deal, how the business is owned, and how proceeds are taxed can all make a six-figure difference to your outcome.

Many owners fixate on the sale price and overlook how much tax, debt, or deferred payment erodes the real reward.

Let’s keep this simple and focused on what matters most in the UK market.

________________________________________

Share Sale vs Asset Sale

These are the two most common ways a business changes hands, and the difference can be dramatic.

For most established SMEs, a share sale is the preferred route because it’s cleaner for the seller and usually more tax-efficient.

However, buyers often prefer asset deals to ring-fence liabilities, meaning negotiation and structuring are key.

________________________________________

Business Asset Disposal Relief (BADR)

Formerly Entrepreneurs’ Relief, BADR can reduce CGT to 18% (14% before April 2026) on qualifying gains up to £1 million per person (lifetime limit).

To qualify, you must:

-

Own at least 5% of the shares and voting rights

-

Have been a company officer or employee for at least two years prior to disposal

-

Sell shares in a trading company, not an investment vehicle

The relief applies per individual, so couples or co-directors can often plan to maximise combined allowances.

Missing a qualifying detail can double your tax, so proper pre-sale planning is essential.

________________________________________

Employee Ownership Trusts (EOTs) – 0% CGT Route

For qualifying businesses, a sale to an Employee Ownership Trust can be entirely free of Capital Gains Tax.

HMRC introduced this structure to encourage long-term employee ownership, and it’s now a mainstream exit route for UK companies with strong staff and consistent profits.

To qualify:

-

The EOT must acquire a controlling interest (over 50% of the shares)

-

The company must be trading, not investment-based

-

The trust must benefit all employees equally

-

The sale must be for fair market value, supported by an independent valuation

Although the tax saving can be substantial, EOTs require careful structuring. They are best suited for sustainable, people-based businesses where continuity and legacy matter as much as price.

For more detail on Employee Ownership Trust valuations and structure, go to EOT.co.uk.

________________________________________

Deferred Payments, Earn-Outs, and Vendor Loans

The headline sale price often includes staged or conditional elements.

If you agree to deferred payments, vendor financing, or earn-outs linked to future performance, you are effectively sharing risk with the buyer.

Each structure carries implications:

-

Deferred consideration: taxed when due or under specific HMRC timing rules.

-

Earn-outs: potentially taxed as income, not capital, depending on terms.

-

Vendor loans: may generate interest income and repayment risk.

A business might sell “for £3 million”, but if half of that is deferred or contingent, the real valuation outcome is much lower once risk-adjusted.

Professional tax advice should be sought before accepting any offer structure.

Good advisers model the net proceeds, after tax, after timing, not just the gross deal figure.

________________________________________

Shareholder Structure and Pre-Sale Planning

If multiple shareholders exist, ensure alignment before valuation or sale discussions begin.

Misaligned objectives create uncertainty for buyers and can derail transactions.

Steps to take well in advance:

-

Review shareholdings, option schemes, and loan accounts.

-

Ensure articles of association and shareholder agreements reflect reality.

-

Resolve director loans or dividends in arrears.

-

Document intellectual property ownership clearly within the company.

Tidy structure equals confidence and confidence equals higher price.

________________________________________

Legal Preparation and Disclosure

Buyers and their lawyers will probe every aspect of your company, so get your paperwork in order early:

-

Statutory books, minutes, and registers

-

Contracts with key customers and suppliers

-

Employment contracts and IP assignments

-

Licences, accreditations, and insurances

-

Lease and property documents

A well-organised data room signals professionalism and reduces negotiation friction.

Surprises during due diligence cost money, almost always yours.

________________________________________

Summary: Structure Determines Net Value (for illustration purposes only)

** Assuming two equal shareholders

The message is simple: how you sell is as important as what you sell for.

Tax planning and structure are part of valuation, not afterthoughts.

If you’d like your business valued with these tax and structure options in mind, request a confidential review today. We’ll assess likely market value, structure suitability, and net outcome before any commitment.

8. How to Increase the Value of Your Business

A valuation is a snapshot of today, not a life sentence.

The good news is that value can be built deliberately, often within 12–24 months, by improving what buyers care about most: profit, predictability, and transferability.

You don’t need to reinvent your company; you need to make it more investable.

Below are the areas that consistently add measurable value before a sale or succession.

________________________________________

Strengthen Profit Quality

Buyers pay for sustainable earnings, not one-off spikes.

Focus on lifting recurring and repeatable profit, even if total turnover stays flat.

Practical actions:

• Review pricing and margin by product or service line — trim unprofitable revenue.

• Reduce customer churn with contracts, service plans, or subscriptions.

• Introduce management reporting that tracks monthly EBITDA trends, not just annual accounts.

• Remove discretionary and personal costs so your profit reads cleanly.

Every £10,000 of verified recurring profit adds £40,000–£60,000 to value at typical multiples.

________________________________________

Build Management Independence

The less your business needs you, the more valuable it becomes.

Document roles, delegate authority, and ensure the business can run on process rather than personality.

Simple but powerful moves:

• Appoint or upskill a general manager.

• Hold structured management meetings with reporting dashboards.

• Create written policies for key operations and financial controls.

• Step back from being the main point of contact for top customers.

When a buyer sees a team that can run the company post-sale, you’ve already justified a higher multiple.

________________________________________

Lock in Customers and Suppliers

Stability sells. Formalising relationships through contracts, renewals, or service agreements reduces perceived risk.

Actions:

• Convert informal client arrangements into written contracts.

• Negotiate longer-term supplier or distribution agreements.

• Diversify customer base — no client should represent more than 15–20% of revenue.

• Build CRM visibility: demonstrate data on retention and lifetime value.

Predictability increases confidence and confidence increases price.

________________________________________

Protect and Showcase Your Brand

Your brand is intellectual property and it can carry serious weight in valuation if it’s properly documented and protected.

To strengthen it:

• Register trademarks, secure key domains, and unify brand presentation.

• Refresh the website and marketing materials to look “buyer ready”.

• Gather reviews, testimonials, and case studies showing consistent client results.

• Showcase awards, accreditations, or press coverage.

Buyers notice presentation. A professional image signals that the business is well run behind the scenes too.

________________________________________

Systemise and Document Everything

A well-documented business is easier to transfer, easier to trust, and easier to scale.

Prioritise:

• Process documentation for operations, finance, HR, and customer service.

• Cloud-based systems for finance, CRM, and project management.

• Clear digital folder structure for contracts, licences, and compliance certificates.

• Management accounts available monthly with clear KPIs.

Businesses that are “ready for due diligence” before they’re marketed often achieve 10–20% higher sale prices because buyers save time and risk.

________________________________________

Reduce Risks That Deter Buyers

Remove avoidable deal-breakers:

• Resolve legal disputes or pending claims.

• Renew insurance and certifications.

• Clear director loans, old debts, or related-party transactions.

• Address lease renewals early.

Every unresolved issue will appear in due diligence, fixing them early keeps you in control and preserves your negotiating power.

________________________________________

Invest in Growth That Shows Momentum

Momentum sells. A business demonstrating active growth attracts competitive tension between buyers.

Growth doesn’t always mean spending big.

• Launch one new service or cross-sell offer.

• Expand into an adjacent region or client type.

• Strengthen digital marketing presence (especially organic search).

• Track enquiry and conversion data to evidence pipeline.

Buyers pay for a story of progress, not perfection.

________________________________________

Get a Valuation Early

Many owners wait too long to discover what their business is worth, losing years they could have spent compounding value.

A valuation isn’t a sale trigger; it’s a planning tool.

It helps you:

• Identify weaknesses to fix before going to market.

• Understand your current value drivers.

• Time your exit to maximise after-tax proceeds.

Early knowledge is strategic power, not commitment.

________________________________________

If you’d like a confidential assessment of what’s holding your value back (and how to lift it before you sell), request a professional review today. Talk to one of the specialist exit planning advisers at ExitPlanning.co.uk

9. What a Professional Valuation Includes

There’s a world of difference between a quick “rule of thumb” estimate and a professionally prepared valuation.

A genuine valuation goes far beyond multiples or online calculators, it captures how a buyer, lender, or tax authority would actually assess your business.

At its core, a professional valuation is an evidence-based analysis prepared by an experienced adviser who understands the market, not just the maths.

________________________________________

Objective Analysis, Not Guesswork

Every owner has a number in mind. Every accountant has a formula.

But real buyers don’t pay based on opinion, they pay based on risk and return.

A professional valuation examines both.

It factors in:

• Financial performance and earnings quality

• Market multiples, recent deal data, and sector benchmarks

• Strength and stability of management and customers

• Strategic value to different buyer types (trade, PE, EOT)

• Legal, tax, and structural implications

• Future growth potential and barriers to transferability

The result isn’t a single number plucked from the air, but a defensible valuation range, supported by facts, logic, and evidence.

________________________________________

Typical Components of a Full Valuation Report

A professional valuation report from an experienced M&A adviser will typically include:

1. Executive Summary – clear overview of findings and methodology

2. Business Profile – key facts, structure, ownership, and trading history

3. Financial Review – analysis of turnover, profit, adjustments, and trends

4. Normalised EBITDA Calculation – reconciled and justified adjustments

5. Valuation Methodology – approaches applied (earnings, asset, DCF)

6. Market Multiples and Comparables – data-backed justification

7. Key Value Drivers and Risks – qualitative analysis

8. Valuation Conclusion – supported range and rationale

9. Appendices – accounts, charts, data tables, and assumptions

This level of transparency is what buyers, lenders, and HMRC recognise as credible.

________________________________________

Indicative vs Formal Valuations

You don’t always need a 40-page report.

A well-prepared indicative valuation can be more than enough to understand your position and plan your next steps.

Both are valuable, one gives perspective, the other gives proof.

________________________________________

The Adviser’s Experience Matters

Numbers alone don’t tell the full story.

An adviser who has negotiated hundreds of business sales knows how buyers think, what they discount, and what they’ll pay extra for.

That experience shapes not only the valuation figure but the strategy behind it.

When you engage an experienced M&A adviser for a valuation, you benefit from:

• Access to real transaction data and current market sentiment

• Commercial realism — not textbook theory

• Honest guidance on saleability, timing, and presentation

• A clear roadmap to increase value before you go to market

________________________________________

Why Online Calculators and Accountants Fall Short

Online tools can’t interpret your management quality, customer retention, or risk profile.

They produce generic numbers, not commercial valuations.

Likewise, most accountants focus on historic data and compliance, not on what a buyer will actually pay.

Professional valuations use forward-looking market logic, how your business will be perceived, financed, and integrated after a deal.

That’s what defines true value.

________________________________________

Deliverables and Next Steps

At BusinessValuation.co.uk, every valuation engagement delivers:

• A confidential discussion with an experienced adviser

• A clear, documented valuation range based on current market data

• Practical feedback on strengths, weaknesses, and sale readiness

• Optional next-step support through our group platforms:

________________________________________

Summary

A proper valuation isn’t about inflating expectations. it’s about understanding the truth before the market does.

It tells you where you stand, what’s driving your value, and what you can fix to increase it.

In short, it’s the difference between hoping for a price and achieving one.

________________________________________

Get a professional valuation prepared by an experienced M&A adviser, not a calculator.

10. Common Valuation Myths

Every business owner has heard a version of “my mate sold his business for five times profit.”

It’s usually followed by silence when you ask what the profit actually was, how the deal was structured, or whether the money was ever fully paid.

The M&A world is full of myths, most harmless, some dangerous. Here are the most common ones, and the blunt truth behind each.

________________________________________

Myth 1: “Turnover is the main measure of value.”

Reality:

Turnover is vanity, buyers pay for profitability and stability, not size alone.

A company turning over £5 million but scraping £100k profit might be worth less than a well-run niche business doing £1 million turnover with £300k profit.

Revenue gives scale; profit gives value.

________________________________________

Myth 2: “My accountant can tell me what it’s worth.”

Reality:

Accountants are excellent at history, they report what happened.

Valuation is about future earning potential and market risk appetite.

Unless your accountant handles active business sales, they’re unlikely to know what buyers are paying in the current market.

Professional M&A advisers base valuations on live deal data, not balance-sheet theory.

________________________________________

Myth 3: “Buyers pay for potential.”

Reality:

Buyers pay for proven potential, not promises.

They’ll only factor future growth into the price if it’s evidenced and achievable without the seller.

If your growth story relies on your personality, network, or risk-taking, it stays a story, not a valuation uplift.

________________________________________

Myth 4: “Add back everything you can the higher the profit, the higher the price.”

Reality:

Buyers spot “creative adjustments” instantly.

Add-backs must be genuine, verifiable, and commercially defensible.

Inflating earnings with personal or recurring costs only damages credibility and drags the multiple down.

Clean, honest numbers command higher trust and, paradoxically, higher prices.

________________________________________

Myth 5: “All businesses in my sector sell for the same multiple.”

Reality:

Multiples are ranges, not rules.

Two firms in the same sector can have identical profits yet sell at opposite ends of the range depending on risk, management depth, and recurring income.

Your individual business model matters more than the industry average.

________________________________________

Myth 6: “I’ll wait until I’m ready to retire, then I’ll sell.”

Reality:

By then, it’s often too late.

Buyers want momentum, not decline.

If you wait until you’re tired or disengaged, performance usually softens, key staff drift, and the value you spent years building starts to erode.

Exit planning should begin two to three years before you want to sell, that’s when you have options, not pressure.

________________________________________

Myth 7: “A higher price always means a better deal.”

Reality:

Price is meaningless without terms.

Deferred payments, earn-outs, or vendor loans can turn a “£3 million deal” into a £1.5 million reality.

The best deal is the one that completes, pays out in full, and protects your legacy.

Focus on structure, not headlines.

________________________________________

Myth 8: “Buyers are lining up, it’ll sell itself.”

Reality:

Serious buyers are selective. They screen hundreds of opportunities and buy a few.

Even good businesses need proper positioning, preparation, and buyer outreach.

Assuming your business will sell itself leads to underperformance or the wrong buyer entirely.

________________________________________

Myth 9: “Valuation is a one-off exercise.”

Reality:

Valuation is part of ongoing exit planning.

Market conditions, profitability, and your role evolve over time.

Having an updated valuation every 12–18 months helps track progress and ensures you never miss your ideal sale window.

________________________________________

Myth 10: “Someone offered me X years ago — that’s what it’s worth now.”

Reality:

That number is irrelevant today.

Market sentiment, interest rates, and buyer appetite have changed.

Old offers are history, not valuation evidence.

The only value that matters is what today’s market is prepared to pay.

________________________________________

The Simple Truth

Business valuation isn’t about guesswork, ego, or hearsay, it’s about evidence, presentation, and preparation.

The sooner you know the facts, the better your decisions will be.

Believing myths delays action; understanding reality creates opportunity.

11. Case Example – From Valuation to Successful Sale

Nothing brings a valuation guide to life quite like a real example.

Numbers are useful, but outcomes are what matter.

This is a true-to-life illustration of how one well-prepared business owner turned a valuation into a successful exit, not through luck, but through planning and execution.

________________________________________

The Business

A Midlands-based engineering services company, family-owned for 25 years.

Turnover around £3.5 million, maintainable EBITDA of £520,000.

Strong repeat contracts with facilities management groups, but the founder remained heavily involved in operations and client relationships.

Like many owners, he thought he’d “just sell when the time felt right.”

A conversation with a professional adviser changed his approach.

________________________________________

Initial Valuation (Year 1)

The indicative valuation placed the business between £2.0 million and £2.6 million, depending on buyer type and risk weighting.

The report identified several improvement areas:

• Heavy owner dependency

• Overreliance on two large customers

• Lack of formal management structure

• No written contracts for long-term service agreements

• Outdated website and inconsistent branding

The owner admitted the valuation was “lower than expected”, but, crucially, it was actionable.

He chose to spend the next 18 months addressing those weaknesses before returning to market.

________________________________________

Preparation Phase (18 Months)

1. Delegation & Management:

Promoted a senior engineer to Operations Director, giving him full client oversight.

2. Contracts:

Converted key customer relationships into formal, renewable agreements.

The top five clients were secured under three-year terms.

3. Brand & Marketing:

Refreshed website, case studies, and ISO certifications.

Added a small marketing retainer to maintain inbound lead flow.

4. Financial Clarity:

Cleaned up the accounts, normalised earnings, and stopped discretionary spending through the company.

5. Succession:

Documented processes, safety protocols, and HR procedures to demonstrate operational resilience.

By the time the next valuation was due, the business looked different and, more importantly, behaved differently.

________________________________________

Updated Valuation (Year 2)

Maintainable EBITDA increased modestly to £560,000, but the multiple rose significantly from 3.8× to 5.5×, reflecting reduced risk and stronger transferability.

Revised Valuation Range: £2.8 – £3.1 million.

The owner was initially sceptical until buyers started confirming it, multiple expressions of interest came in within weeks of marketing.

________________________________________

The Sale

A regional trade buyer in the same sector recognised immediate synergies: shared customers, overlapping geography, and scalable service contracts.

After structured negotiation and limited exclusivity, the deal was agreed at £3.05 million, a mix of 90% cash on completion and 10% deferred for six months post-handover.

Total time from relaunch to completion: seven months.

________________________________________

The Outcome

Compared with the original valuation:

• Headline price up: +£850,000

• Completion achieved: within two years of planning start

• Vendor retained no ongoing risk or involvement

• Buyer integration smooth and staff retained

The result wasn’t luck.

It was the product of preparation, delegation, and professional positioning.

The owner described the outcome simply:

“The valuation told me the truth. Acting on it turned that truth into a result.”

________________________________________

Key Takeaway

Valuation isn’t the end of the process, it’s the beginning.

Handled correctly, it becomes a blueprint for value creation, not just a number on paper.

For business owners willing to act, a professional valuation can be the most profitable report they ever commission.

________________________________________

To understand where your business stands today and what steps would move it into a higher valuation range, request a confidential review with an experienced adviser.

12. When and How to Get Started

The best time to get a professional business valuation isn’t when you’re ready to sell, it’s when you’re ready to plan.

Valuation isn’t a signal to retire; it’s a tool to take control of your next chapter.

Whether you plan to sell in one year or ten, the first step is understanding where you stand right now.

________________________________________

When to Commission a Valuation

You should request a professional valuation when:

-

You’re considering selling or bringing in an investor

-

You’re curious what the market would pay for your business today

-

You want to benchmark progress and measure growth value over time

-

You’re exploring exit routes such as trade sale, MBO, or Employee Ownership Trust

-

You’re conducting succession, divorce, or shareholder restructuring

-

You simply want an independent view, not biased by optimism or accountancy conventions

Waiting until a buyer appears or retirement looms is a mistake. By then, your leverage is gone and your options narrow.

A Business Valuation is about control, not commitment.

________________________________________

The Process – Simple, Confidential, and Insightful

At BusinessValuation.co.uk, the process is straightforward:

-

Initial Discussion – confidential conversation to understand your business, objectives, and timescale.

-

Data Review – analysis of your last three years’ accounts and key commercial factors.

-

Indicative Valuation – written report detailing valuation range, risk assessment, and improvement opportunities.

-

Next Steps – follow-up discussion on your options: hold, prepare, or proceed to market through one of our partner brands.

The process is handled discreetly by experienced M&A professionals, not software or junior analysts.

No obligation. No pushy sales. Just facts and insight.

________________________________________

Why Early Insight Creates Better Outcomes

A valuation gives you time, time to plan, fix issues, and build leverage.

Business owners who act early achieve higher valuations, better terms, and cleaner exits.

Those who wait often sell reactively, under time pressure, at discounted prices, and with unnecessary tax leakage.

Early valuation = stronger strategy = better deal.

________________________________________

The Value of Confidentiality

Every enquiry is treated in the strictest confidence.

Your details are never shared publicly or marketed.

We act for serious business owners who value privacy, integrity, and professionalism.

That’s why our clients come to us first, and stay with us when the time is right to act.

________________________________________

Ready to Take the First Step

You don’t need to be ready to sell, you just need to be ready to know.

A professional valuation will give you clarity, confidence, and a plan.

Discover what your business is really worth and how to increase it before you sell.

Final Word

You’ve spent years building your business.

Understanding its true value isn’t about selling, it’s about protecting what you’ve created.

Because in today’s market, information isn’t just power, it’s profit.

If you would like to talk to an experienced business sale adviser, go to exits.co.uk

End of Guide

BusinessValuation.co.uk — 2026 Edition